After 3 years of activity with 500 to 600 startup candidates per year, we have now seen a critical mass of European mobility startups . Our co-founders at Via ID, crunched the accumulated data and provide us with insight on Europe’s up-and-coming mobility technologies, business models, and start-ups*:

EUSP: a growing proportion of innovation in European mobility solutions

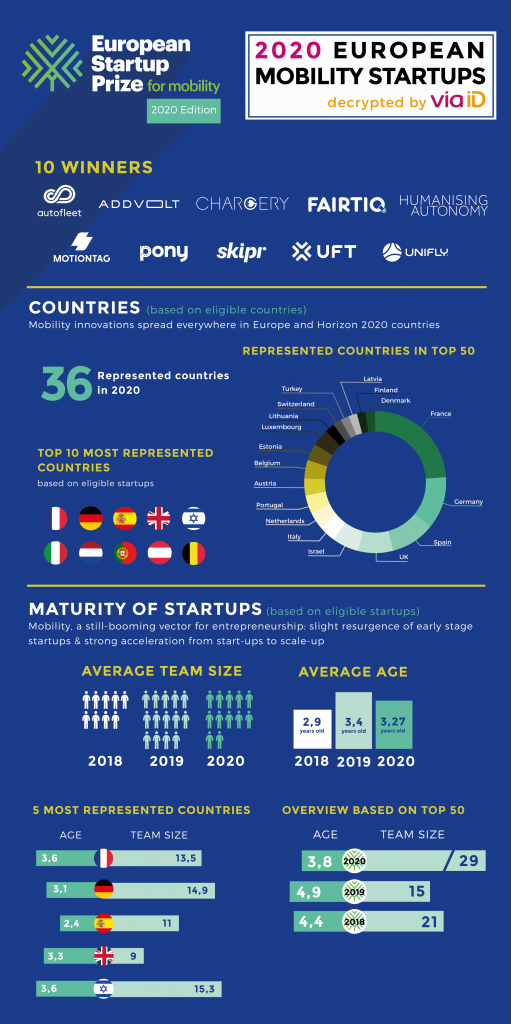

With 36 countries represented compared with 18 last year, innovation in mobility solutions is playing an ever-increasingly important role in Europe The gap between the TOP5 countries with the most start-ups is narrowing, with the proportion of French, German (+64% compared with 2019), Spanish, British start-ups increasing all the time. What’s more, the Israeli start-ups have entered the leader board, given the opening of the EUSP to the Horizon 2020 programme. It’s also worth noting the increasing importance of start-ups from central and eastern Europe (16% of eligible start-ups, outside Germany) and the Baltic nations, particularly Estonia and Lithuania (TOP12 and 13 of the countries with the most start-ups).

Mobility, an entrepreneurial impetus that is growing all the time

With more than 550 candidate start-ups this year and a slight drop in the age of eligible start-ups compared with 2019 (3.27 years old on average and teams of 12 candidates), the EUSP reflects the feverish mood of the European entrepreneurial landscape in mobility solutions.

The ecosystem, boosting growth and expertise

Depending on the country, start-ups need more or less time to develop. In part, this can be explained not only by the favourable cultural (and legislative) environment, but also by the sectors that they deal with. However, since the first EUSP event (2017-18), the growth rate of start-ups by nationality has not changed significantly.

The country where start-ups are most mature is Israel, followed by France and Germany. This is where the local ecosystem is most mature and positive towards mobility solutions (cooperation of public/private agents, proactive legislative landscape) and a culture of “mobility” has been historically strong. These are also countries with a high concentration of tech expertise and subjects, which is a key factor of success/foundation stone of smart mobility solutions. In Europe, the fastest-growing start-ups are the German ones (3.1 years old and almost 15 employees on average). This reflects the “rocket internet” culture that is freeing up significant resources, which are rapidly devoted to the application of an identified business model. As for the British start-ups, they are developing leaner business models with fewer staff members (3.3 years old and 9 employees on average in 2020), which essentially focus on mobility services.

Start-ups, which are breaking even more quickly

The most spectacular acceleration concerning the start-ups of the TOP50, which are now attaining a critical size of 29 people in under 4 years, compared with about 15 employees on average, after a period of 5 years of activity, in 2019. This reflects the increasing maturity of the mobility sector and an increasing focus of agents and capital on the right issues at the right time.

Supremacy of service-oriented platforms and start-ups, growing importance of electric mobility solutions and micro-mobilities

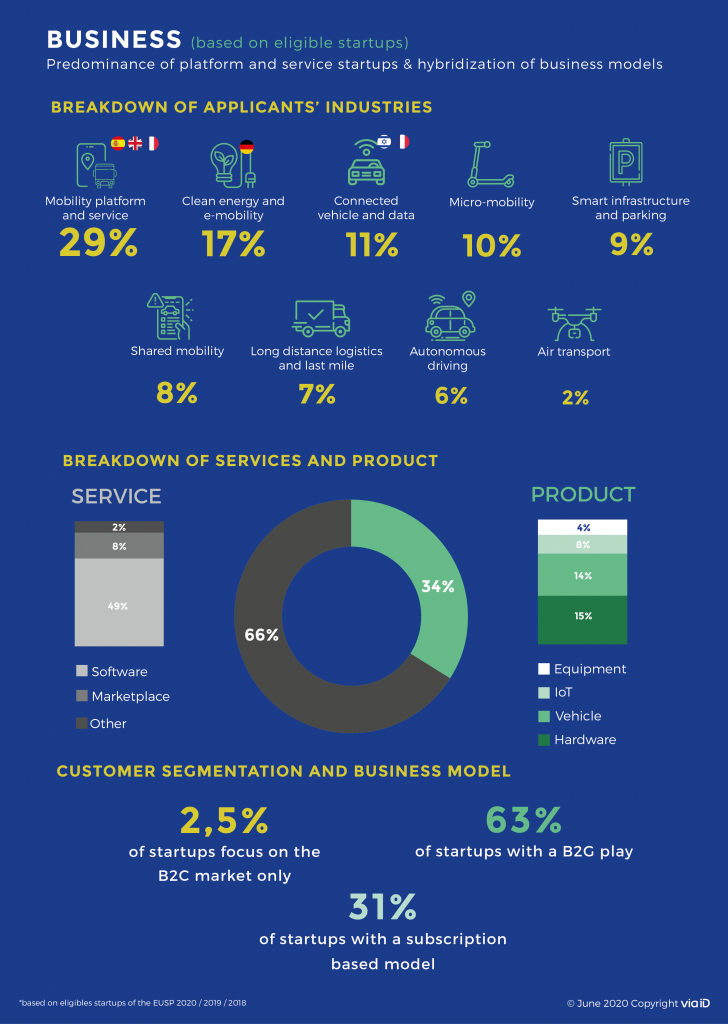

Mobility platforms and services are the big winners of the topical leader board, representing 29% of eligible start-ups.

Start-ups develop where new needs emerge and where problems can be resolved by innovation

The rapid growth of new mobility solutions (car sharing, car pooling, etc.) – still strongly represented two years ago – has boosted the need for mobility facilitators and multimodal solutions: This has freed up space for MaaS and its components, the aggregation of services, demand-responsive transport, etc., which provide solutions in this area and simplify the user experience in coping with these new offers.

This phenomenon is itself amplified by the rapid growth of micro-mobilities and shared mobility solutions which represent 18% of the eligible start-ups, i.e. suppliers, operators, aggregators, infrastructures and their associated services, which are flourishing everywhere in Europe.

What’s more, the effects of changes in public policy in support of the electric mobility sector and in favour of the energy mix is becoming evident, with 17% of the eligible start-ups belonging to this category.

Finally, the self-driving car (6% of the eligible start-ups) and aerial mobility (2%) are still modest in terms of volumes, revealing the more complex obstacles to entry in terms of R&D, long-term financial resources, technology and regulation.

Hybridisation of business models

The exclusive B2C and B2B models are being overtaken by multi-agent approaches that incorporate the public sector client as a foundation stone of mobility systems: Only 2.5% of start-ups claim to focus only on private individual customers. What’s more, 63% of start-ups sell their solutions to public institutions (among others).

This is the reflection of a sector – urban mobility solutions in particular – that has been significantly subsidised in the past, and which still needs public support in most cases, despite the work done to reinvent itself that has indeed been done.

Mobility solutions that are increasingly aiming at “subscription-based” consumption. For more than 31% of start-ups, this is their main source of revenue. A model that reflects the rapid growth of Mobility as a Service and the objective of switching from possession to use that has been observed in many sectors.

*Analysis based on 375 start-ups from the EUSP 2020

For more information about this analysis, contact Sophie Bailly, Partnership Manager at Via ID.